Overview of Consumer Protection Act 2019, Amendments made to the act and its effect.

Abstract

The Indian Consumer Protection Act, 1986, which was enacted to provide timely relief to consumers who were affected by defective products or poor service, as well as provide both a legal and institutional framework for the protection of consumer rights, has been criticised for being ineffective on some fronts. On the other side, the rise in cases of unfair commercial practises and deceptive advertising prompted legislative adjustments. As a result, the new Consumer Protection Act, which was passed in 2019, aims to impose stricter regulations in order to successfully safeguard customers. It is the first time that it provides for ‘criminal’ remedies by criminalising a few wrongdoings. We will focus on what adjustments have been incorporated to the new act through this research. What were the faults of the 1986 act that the 2019 act ratified? What impact will it have on ongoing cases? The study will be a descriptive or qualitative study, with the act itself as the major source, as well as publications and commentaries.

Keywords: Consumer Protection Act of 2019, amendment, consumer, unfair commercial practise

Introduction

Consumer rights must be maintained in order for any economy to thrive. A consumer is an essential component of any economy since he is the individual who purchases or rents goods or services from a seller, hence increasing employment in the country. As a result, defending consumer rights is critical, because consumer wants and expectations have shifted as a result of globalisation and increased awareness. However, because not all sellers and service providers are legitimate, the availability of a huge number of goods and services can sometimes be harmful to the consumer.

The Consumer Protection Act of 1986 was enacted to address consumer problems and safeguard their interests. It was a commendable step at the time, and it was modified from time to time. However, the country’s three-decade-old legislation has not kept up with market and digital technological advances. For example, the Act did not grant the right to pursue a person who had infringed a consumer’s rights, therefore customers had to turn to the State and District Consumer Redressal Forums, which merely paid them for their losses. There was no data collecting and no investigation of injuries or deaths caused by defective products or services. In summary, there was no regulatory authority in place to monitor or control consumer rights violations.

The Consumer Protection Bill, 2019 was enacted by Parliament on August 6, 2019, to replace the Consumer Protection Act, 1986. The President of India gave his assent to the Consumer Protection Act, 2019 on August 9, 2019, and it would go into effect when the Central Government notifies it. The 2019 Act’s purpose is to ensure efficient and effective administration and resolution of consumer disputes and related issues.

Rather than amending the 1986 Act, the government enacted a new Act to provide enhanced consumer protection, taking into account the booming e-commerce industry as well as modern methods of providing goods and services such as online sales, teleshopping, direct selling, and multi-level marketing, as well as traditional methods.

Short comings of the Previous act

The United Nations ‘Guidelines for Consumer Protection, first published in 1985 and updated in 2016[1], reintroduced States’ adoption of a “useful set of principles” through consumer protection legislation. It requires States to make every effort to achieve specific standards in this regard, including the protection of vulnerable and disadvantaged consumers, as well as the protection of consumers from health and safety dangers. Thus came into existence the Consumer Protection Act 1986. But along with the change of time several shortcomings came into existence of the act.

The 1986 Act was enacted to protect the rights and interests of consumers. However, its provisions, as well as its institutional framework, had several flaws. Despite having specific measures to protect consumers from unfair trade practises and other types of violations of consumer rights, the Act failed to regulate certain wrongs perpetrated against them. The problem of product responsibility was one among them. Allegations of excessive lead concentration in Maggie noodles, as well as flaws in Volkswagen cars, are just a few examples of events that have generated concerns about the ineffectiveness of legislation in avoiding such incidents. Because defects in products such as food can cause ‘damage’ to customers, there was a need for a strict and deterrent legal process by which producers, distributors, and others dealing with such products could be held liable. Another legal issue that needed to be addressed was celebrities supporting goods through commercials, so influencing and, in some cases, misleading consumers in their purchasing decisions. ‘Celebrities have a huge effect on customers and are guided by the decisions they make or promote,’ says Srinivasan K Swamy, Chairman, Advertising Standards Council of India (ASCI). Both celebrities and advertisers must be aware of the influence and power of advertising in order to make responsible claims in order to promote products or services.’

False and misleading advertisements infringe on a number of consumer rights, including the right to information, the freedom to choose, the right to be protected against harmful goods and services, and the right to be free from unfair trade practises.[2] Tata Motors was recently fined Rs. 1,50,000 by the National Consumer Dispute Redressal Commission for deceiving a consumer with deceptive advertising.[3]

This is one of the many cases in our country where the consumer has been aggrieved by the seller or the manufacturer. Some other important decisions by the court are:

Karnataka Power Transmissn.corp.ltd & anr v. Ashok Iron Works Pvt. Ltd,[4] Ashok Iron Works, a private iron-producing company, had filed for electricity from the state’s power generation organisation, the Karnataka Power Transmission Corporation (hereafter KTPC), in order to start producing iron. Despite paying costs and receiving confirmation for a 1500 KVA electricity supply in February 1991, the real supply did not commence until November 1991, ten months later. Ashok Iron Works suffered a significant loss as a result of the delay. This firm filed a complaint with the Belgaum Consumer Dispute Forum, which was later taken up by the Karnataka High Court. KTPC’s legal argument was that the complaint could not be upheld since the Consumer Protection Act of 1986 does not apply to commercial sale of goods. It also claimed that the corporation was engaged in the fabrication of iron with the intention of using it for commercial purposes, which is prohibited under the Act. He further stated that the complainant does not qualify as a “person” as defined by Section 2(1)(m) of the Act of 1986.

The Supreme Court rendered its decision in this case. The Supreme Court cited the General Clause Act, which includes a private corporation in the definition of “person.” It was also decided that the KPTC’s delivery of energy to a consumer would fall under the definition of’service’ under Section 2(1)(o). Also, if the electrical energy consumer is not delivered to a consumer within the agreed-upon time frame, there may be a case for deficiency in serviceunder Section (2)(1)(g). As a result, the section prohibiting the “supply” of commodities for commercial purposes would not apply. On these grounds, the Supreme Court remanded the matter to the District Forum for a retrial.

Manjeet Singh v. National Insurance Company Ltd. & Another[5] In this instance, the appellant had used a Hire Purchase agreement to purchase a second-hand truck. The respondent insurance firm was responsible for insuring the car. A passenger begged him to stop the truck and give him a ride one day while he was driving. When he came to a halt, the passenger assaulted the driver and took off with the vehicle. The theft was reported to the respondent finance business, and a FIR was filed. However, the claim was denied by the insurance company due to a violation of the policy’s conditions. The plaintiff sought compensation through the District Consumer Disputes Forum, the State Commission, and the National Commission. The lawsuit had been dismissed by all of them. As a result, he went to the Supreme Court.

The Supreme Court ruled that the applicant was not at fault in any way. Bringing the insurance policy to an end and terminating the insurance policy can be regarded a policy breach, but not a fundamental one. The Supreme Court’s two-judge panel ordered the respondent insurance company to pay 75 percent of the insured sum plus 9% interest per annum from the date of filing the claim. The court also ordered the insurance firm to pay a compensation of Rs. 1,00,000 to the plaintiff.

In these cases the aggrieved was given relief by the Supreme Court of India. The lower courts felt the existing act to be a bit ambiguous thus, the appellate court felt the need to give a different interpretation so that the aggrieved will get justice.

Consumer Protection Act, 2019

Seeing the shortcomings of the previous act the legislators felt a need to overcome these obstacles. The lawmakers thus repealed the previous act and enacted a new one. The main features of the Consumer Protection Act 2019 are:

- The term ‘consumer’ is defined in further depth.

According to Section 2(7) of the 2019 Act, a consumer is anyone who buys things or receives services for a fee, and includes anyone who uses those services or goods for the purpose of resale or commercial usage. According to the definition’s explanation, “buys any things” and “hires or avails any services” encompasses all online transactions conducted through electronic means, as well as direct selling, teleshopping, and multi-level marketing. This legislation has a special feature of online transactions, which was adopted in response to the rising e-commerce industry and technological advancements.

- Under the 2019 Act, the terms “unfair trade practise” and “unfair contract” are defined.

Unfair trade practise is defined under Section 2(47) of the Consumer Protection Act of 2019. The definition of “unfair trade practise” has been expanded to include practises such as manufacturing or offering counterfeit goods for sale or using deceptive practises to provide service, failing to issue a proper cash memo or bill for services rendered and goods sold, refusing to withdraw, take back, or discontinue defective goods and services and refund the consideration taken within the time period stipulated in the bill or within 30 days if there is a dispute, and refusing to withdraw, take back, or discontinue defective goods and services and refund the consideration taken.

The term of unfair trade practise under the abolished Act of 1986 did not cover online misleading marketing, which was incorporated in the 2019 Act.

The concept of an unfair contract was also established by the 2019 Act. Section 2(46) defines an “unfair contract” as any contract between a consumer and a manufacturer, service provider, or trader whose conditions result in a significant change in the consumer’s rights under the Act. These terms include, for example:

- Exorbitant security deposits by the consumer in order to facilitate the fulfilment of the contract’s duties;

- Placing a penalty on the consumer for breach of contract that is not proportional to the loss sustained as a result of the violation;

- Refusing to accept early debt repayment with the associated penalty;

- Permitting one of the parties to unilaterally or without reasonable reasons cancel the contract;

- Allowing one party to assign the contract without the customer’s agreement and to the harm of the consumer;

- Putting the consumer in a disadvantageous position by imposing an unjustified condition, duty, or charge.

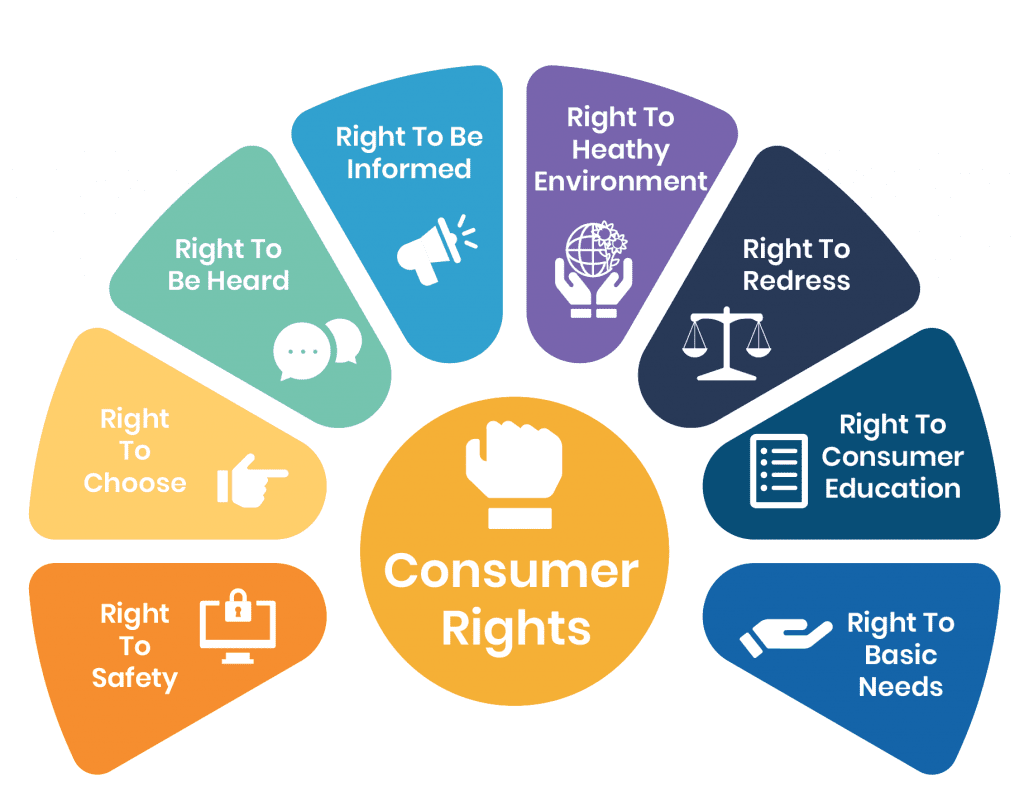

- Consumer Rights

Consumers have six main rights under the Act, which are as follows:

- The right to be shielded from the marketing of goods, products, or services that endanger life or property;

- The right to be informed about the quality, amount, potency, purity, standard, and price of commodities, products, or services in order to protect consumers from unfair commercial practises;

- The right to have access to a wide range of goods, products, or services at reasonable rates, wherever possible;

- The right to be heard and the assurance that the consumer’s interests would be taken into account in suitable forums;

- The right to seek remedies in the event of unfair trade practises, restrictive trade practises, or consumer exploitation; and

- The right to be informed as a consumer;[6]

- The Central Consumer Protection Authority is established.

A Central Consumer Protection Authority (CCPA) was established under the Act of 2019 to handle cases involving consumer rights violations, misleading or false ads, unfair trade practises, and consumer rights enforcement. The members of the CCPA shall be appointed by the central government. The authority will be made up of a Chief Commissioner and other members as needed.

The CCPA’s tasks are defined in the 2019 Act, as well as who will appoint its members. However, it is unclear how the CCPA would carry out its responsibilities and what techniques it will use to accomplish them. There are no qualifications for the CCPA’s members to be recruited. Furthermore, the Central Government’s appointment of members of the CCPA will have an impact on the authority’s independence. In a disagreement where the government has supplied inadequate services, the customer may be at a disadvantage.

- Penalties for Misleading Advertising

One of the many issues added by the 2019 Act is misleading and fraudulent advertising. The repealed Act does not address the issue of deceptive and false advertising. Misleading advertising is defined in Section 2(28) of the Act as any advertisement that provides a false description of a product or service, provides a false guarantee, conveys express representation constituting unfair trade practise, or intentionally withholds essential information about the product.

Anyone who publishes false and misleading advertisements is subject to jail or a penalty of up to ten lakh rupees under Section 21(4) of the Act. In addition, Section 21 (3) of the CCPA specifies that the endorser of any such misleading and fraudulent ads might be barred from endorsing any other products or services for a year. The publisher of any deceptive advertisements is also liable for the effect of such advertisements to be neutralised.

- Liability for Products

One of the notable and crucial moves contained in the 2019 Act is product liability. This notion is dealt with in detail in a separate chapter of the Act.

If a complaint is harmed as a result of a defective product or service, he can file a product liability lawsuit against the manufacturer, service provider, or seller.

- A product manufacturer will be held accountable under Section 84 of the Act if the product has a manufacturing fault, is defective in design, does not follow manufacturing requirements, does not comply with implied guarantee, and does not include adequate instructions for proper product use.

- In a product liability action, Section 85 of the Act discusses the service provider’s liability. To be liable under this section, the service provided must be deficient, faulty, inadequate, or imperfect, as well as an act or negligence withholding any information that is responsible for the harm caused, as well as a lack of adequate warnings and instructions, as well as conformance to express warranty or contractual terms.

- If a product seller exercises substantial control over the product’s manufacturing, testing, design, labelling, or packaging, the seller will be responsible in a product liability case. There was a significant alteration or modification that resulted in the injury. The product seller provided an explicit guarantee that differed from the manufacturer’s warranty. The product vendor failed to maintain, assemble, or check the product with reasonable care.

Exceptions

There are also certain exceptions to product liability claims. Section 87 of the 2019 Act discusses these exceptions. A product liability claim cannot be filed by a consumer who misuses, alters, or modifies the product and suffers harm as a result.[7] A consumer cannot sue for product liability if the product manufacturer provided adequate warnings for its use, the product was purchased as part of another product and the end use caused damage, the product was supposed to be used under expert supervision, or the product was used while under the influence of alcohol.[8] A product producer will not be held accountable for failing to warn about a known or obvious danger.

- Forums for Consumer Dispute Resolution

Jurisdiction

- Territorial Jurisdiction: A complainant can now register a complaint in the jurisdiction in which he or she lives or works. The repealed Act limited the complainant’s ability to file a complaint to the location where the other party conducts business or resides. The complainants had a lot of problems as a result of this.

- Pecuniary Jurisdiction: Rather than the compensation sought under the repealed Act of 1986, pecuniary jurisdiction will now be decided based on the consideration paid for the value of goods acquired and services obtained. The 2019 Act also enhanced the pecuniary jurisdiction limit for the several commissions. The District Commission will now handle matters worth up to one crore rupees, up from the previous limit of Rs. 20 lakhs under the repealed Act. The State Commission’s pecuniary jurisdiction limit has been set at Rs. 1 crore to Rs. 10 crores, while the National Commission will handle cases worth more than Rs. 10 crores.

- ADR (Alternative Dispute Resolution) is a method of resolving

The Consumer Dispute Redressal Forum may recommend the parties to mediation with their cooperation if it appears to the Forum that the consumer dispute can be resolved through mediation.[9] The State Government shall create a consumer mediation cell for each District Commission and State Commission for the purpose of mediation. The National Commission will be connected to a consumer mediation cell established by the Central Government. According to the regulations, the consumer mediation cell will be responsible for maintaining a list of empanelled mediators, cases handled by the cell, a record of proceedings, and other information. The cell is also required to provide a quarterly report to the commission to which it is affiliated.[10]

- Digitalization

Several new sections relating to digitization have been incorporated into the new Act. Given the widespread adoption of e-transactions, this desirable development had become inevitable. As a result, consumer rights had to adapt as well.

Effect of the new act on ongoing cases

In the year 2019, the long-awaited revisions to the Consumer Protection Act (CPA) went into effect. Several amendments were made in the new Act, including increased monetary jurisdiction, payment of costs for filing appeals, and powers to implement orders, among others. The legislators, however, failed to indicate whether the new revisions will apply retroactively or prospectively. This is critical since there are several complaints pending with various forums and commissions around the country. The application was dismissed by an NCDRC co-ordinate Bench on the basis that the Commission’s President issued an administrative order indicating that the Consumer Protection Act 2019 is not retrospective, but prospective in application.

Punishment under the new Consumer protection act 2019

A person, by himself or through someone else on his behalf, manufactures, sells, stores, imports, distributes any product containing an adulterant will be punished with:

- In case of no injury to the consumer – imprisonment up to 6 months and a fine of up to 1 Lakh rupees.

- In case of injury not amounting to grievous hurt – imprisonment up to 1 year and a fine up to 3 Lakh Rupees.

- In case of grievous hurt – imprisonment up to 7 years and a fine up to 5 Lakh Rupees.

- In case of death of the consumer – imprisonment of not less than 7 years, which may extend to life, and a fine of not less than 10 Lakh Rupees.

A person, by himself or through someone on his behalf, who manufactures, sells, stores, imports, distributes spurious goods will be punished with:

- In case of injury not amounting to grievous hurt – Imprisonment up to 1 year and a fine of up to 3 Lakh Rupees.

- In case of grievous hurt – Imprisonment up to 7 years and a fine up to 5 Lakh Rupees.

- In case of death of a consumer – Imprisonment of not less than 7 years, which may extend to life, and a fine of not less than 10 Lakh Rupees.

False and misleading advertisement, by any manufacturer or service provider:

- Imprisonment may extend to 2 years and a fine that may extend to 10 Lakh Rupees.

- In case of Subsequent Offences – Imprisonment may extend to 5 years and a fine may extend to 50 Lakh Rupees.

Conclusion

It is possible to conclude that, despite the existence of various regulations designed to protect consumers from unfair economic practises, deceptive and misleading marketing continue to abuse customers. If the hour is better laws that are current, better enforcement, corrective commercials, and greater self-regulation by industry independent regulators to oversee health and children-related advertisements, then the hour is now. Some of the flaws in the control of advertising include outdated legislation and weak enforcement. Consumer education and government, consumer activist, and association initiatives, on the other hand, are critical to the success of the consumer protection movement in the country.

Written by – Erwin Thomas Wilson

[1] UN Guidelines for Consumer Protection, UNCTAD, United Nations, New York (2016).

[2] Pushpa Girimaji, Misleading Advertisements and Consumer (Consumer Education Monograph Series 2, Centre for Consumer Studies Indian Institute Of Public Administration, 2013).

[3] Tata Motors Ltd v Pradipta Kundu, National Consumer Disputes Redressal Commission, Revision Petition No 2133 (2015).

[4] Karnataka Power Transmissn.corp.ltd&anr v. Ashok Iron Works Pvt. Ltd, AIR 2009 SC 1905.

[5] Manjeet Singh v. National Insurance Company Ltd. & Another, AIR 2017 SC 5795.

[6] Section 2(9) of the Consumer Protection Act, 2019.

[7] Section 87(1) of the Consumer Protection Act, 2019

[8] Section 87(2) of the Consumer Protection Act, 2019

[9] Section 37 of the Consumer Protection Act, 2019

[10] Section 74 of the Consumer Protection Act, 2019